Any business, large or small, has many types of expenses during the year. Some may be one-time equipment purchases. Or, they could be recurring monthly or annual charges for things like rent, insurance, business software, etc.

If you’re considering strategic planning for small business growth in the near future or looking to maximize your profits and cut back on spending, review your budget and audit your business expenses.

Auditing expenses for a small business budget requires looking at every expense, line by line, and determining your return on each dollar spent. This process allows business owners to determine which expenses can be cut or scaled back without sacrificing revenue.

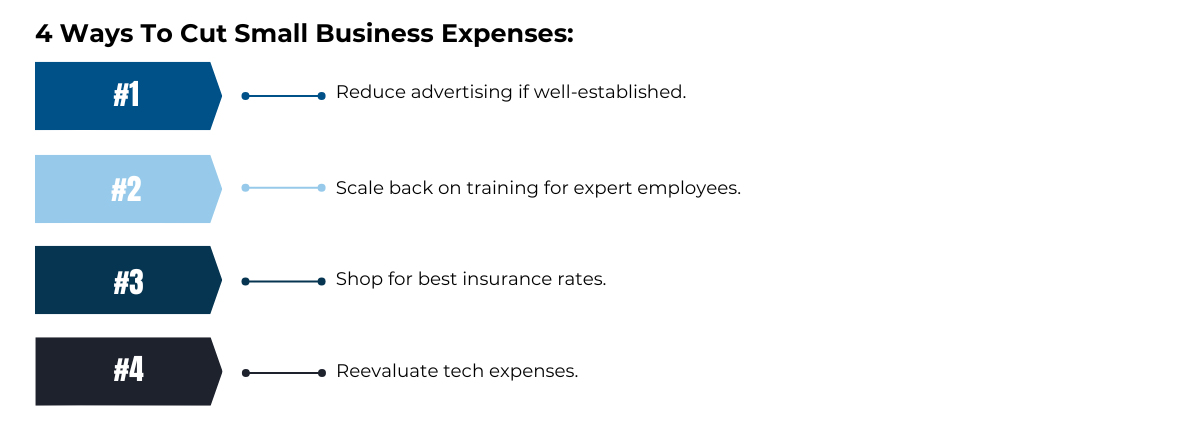

There are many small business expenses that cannot be cut from the budget or scaled back. However, small businesses may be overpaying for some services or products. Here’s how to reduce expenses in business:

In most cases, growing a business means hiring additional employees. Look at which expenses are fixed and which are variable. For example, hiring an additional employee may not change the amount you pay for rent, but it will affect how much you pay for pension, uniforms, payroll and insurance.

Before hiring, make sure that the anticipated revenue increase will exceed the additional cost of that employee.

Typically, the best time to audit expenses is after the first of the year as you are preparing your taxes. Get your accountant, your banker and any high-ranking, trustworthy managers from your business involved in the process.

Once your taxes are done, ask your accountant for a profit and loss statement. You and your managers can look at expenses line by line to see where every dollar went throughout the year.

A business banker at Northwest Bank can look at those expenses with you and help you decide what kind of return you are getting on those investments. They may also be able to offer advice about where you can scale back. For example, if you are planning on spending money on new equipment for your business this year, we can objectively walk you through the true cost — including maintenance and hiring an employee to operate the equipment — to help you make the best decision.

Contact a business banker today to learn more.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105