You’ve spent years building a successful company from the ground up: navigating challenges and celebrating milestones. The time is approaching for you to step away and retire, but you haven't given any thought to who will take over or how the business will continue to thrive without you.

This scenario is far more common than you might think. The single most neglected aspect of business ownership is having a plan in place so you don’t make the same mistake as others. You must plan for your future — especially if you’re nearing retirement and want to have a solid business exit strategy in place.

Here are the answers to a few questions about business succession planning.

Evolving your business is inevitable. Perhaps you will pass along your business to your family, business partner, key employee or a combination of the three. You may decide on selling a business to a third party instead. Whatever you decide, it’s best to be in control of the process and determine whom you want to take over your business. You do not want to run into unexpected issues, like an injury or medical diagnosis, with no successor in place and no plan for the future.

Transferring your business ownership can be a daunting task, so it’s important to get started early. It doesn’t matter if retirement is on the horizon or a decade away; having a succession planning framework in place years before a transition takes place can give you better peace of mind about the business you’ve worked hard to build.

Filling out a business succession planning questionnaire is a great way to get the process started. Here are some sample questions:

Selling a small business comes with significant financial considerations. Whether you decide to sell your business or transfer ownership through your will or a trust, ask yourself these questions:

There are also emotional factors to respect when writing your small business succession plan. The biggest emotional consideration is finding your new identity after transferring your business. It’s important to have a hobby or passion outside of your business that will help take you into the next phase of your life. How do you answer the following questions:

Preparing a business succession plan comes down to anticipating and communicating. The first step is to consider the timing of your exit. For example, do you want to work for 5 to 10 more years, or are you ready to step away today?

Next, determine who should be a part of the initial planning conversations. Should a family member, business partner, client, or third party be a part of the process? Make sure you have the right people in the room, including your CPA, attorney, financial advisor and potentially a M&A broker, to start these discussions.

Finally, it’s important to determine who might be a good fit to purchase your business. Is there an heir who embodies your values and philosophies? Do you have a key employee who is interested in the business if you do not have a co-owner or family member that you trust with your business? Is there another entrepreneur or third party to take over your business if there is not a clear successor? This decision may come down to how much money you need or would like to get from the sale of your business.

Don’t let communication take a back seat when mapping out your business succession plan. Without clear communication, even thriving companies can fall apart. This often happens as a business grows and communication breaks down between family members or other key players. When people aren’t talking, it can lead to assumptions, fostering rivalries and not having a succession plan in place. It’s critical to talk to everyone who will be affected by your plan and ask for help from others, especially experts and trusted advisors.

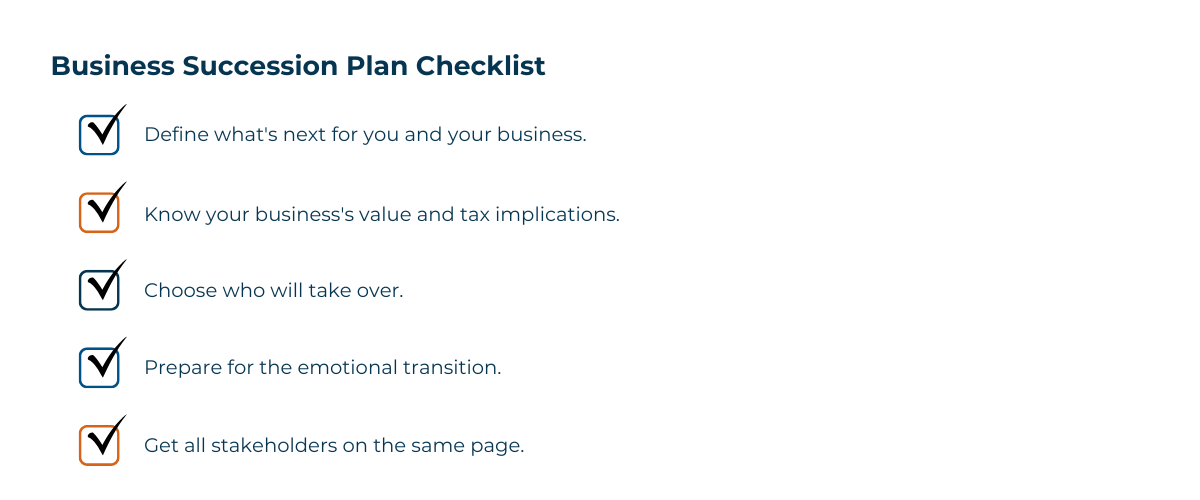

Develop a timeline to let stakeholders know about your plan. It may be beneficial to have a meeting where you talk about the business and get everyone on the same page. During this meeting, outline your personal goals, timeline and business vision and values. Then put together a list of action items and ideas along with a small business succession planning checklist on what to complete before your next meeting.

Whether you are looking to transition your business to your family or sell to another company or buyer, it’s essential to start early and have an exit strategy. However, you don’t have to build your plan all by yourself. Our Northwest Bank Wealth Management Advisors are available with the tools, resources and business succession planning advice you need to get started. You can find additional resources through the UNI Family Business Center.

Reach out to one of our Northwest Bank Business Bankers today to learn how to develop your business succession plan.

Advisors represent Northwest Wealth Management, a registered investment advisor and affiliate of Northwest Bank. Not FDIC insured. No bank guarantee. May lose value.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105