Annuities are a popular way to supplement retirement income, provide tax-deferred growth and assist in legacy planning. But what are your options when an annuity no longer serves you?

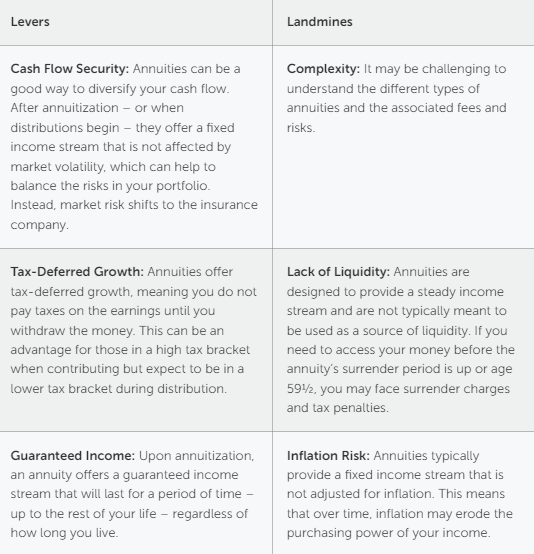

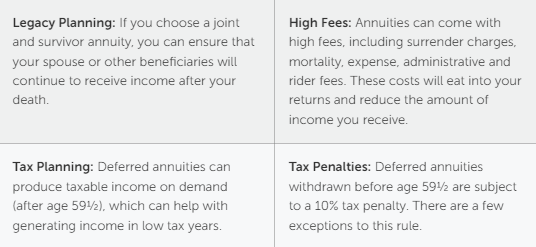

Annuities can be a key component in a robust retirement plan. These insurance contracts provide a low-risk opportunity to increase your guaranteed income stream, provide tax-deferred growth and assist in legacy planning. Although the basics of annuities are the same, each insurance company, contract and situation is different. Most commonly, consumers can purchase deferred variable or fixed-indexed annuities before retirement, either through a series of payments or in one lump sum, in exchange for regular disbursements in retirement. Each annuity contract has both pros and cons. Depending on the type of agreement, you may encounter the following:

As a rule of thumb, when buying a new policy or reviewing an existing annuity, consider these important points:

Due to an unexpected financial situation, sometimes individuals find their annuity is no longer necessary or not fulfilling the role imagined. Unfortunately, when an annuity is sold to you on a commission basis, you will be charged if you close out your contract during the surrender period, which may run between three to 14 years. While these fees can rarely be avoided during this time, there are ways to circumvent or continue to defer taxes when you leave a high-cost annuity.

If an individual no longer needs an annuity as is, it is possible to surrender the annuity and pay tax on any gains. If the gains would be too expensive or you’d experience a loss, you can transfer the annuity to another annuity contract without tax consequences. This is referred to as a 1035 exchange.

A fee-only financial planner may recommend transferring outdated annuities from high-cost products to low-cost, surrender-free annuities that meet clients’ current needs and continue to allow for tax-deferred growth.

As a bonus, an individual may use a 1035 exchange to transfer the cash value from an unneeded life insurance policy. Often the cost basis of life insurance is higher than the policy’s cash value due to the internal costs of insurance. If an individual surrenders their insurance policy or annuity with a loss for cash, the loss is not recognized when taxed. Within an annuity the growth or loss is tax deferred, so you can hold an underwater annuity until the loss is recovered, tax free

By transferring multiple old insurance or annuity policies into a single annuity, the gains and losses will offset each other to reduce the overall tax burden. The contract owner must be the same on all old and new policies. For example, the same owner can transfer an annuity with a gain and a life insurance policy with a loss into a new, low-cost, no-surrender annuity policy to offset the gain and loss. While annuities can provide benefits like consistent income stream or offer tax-deferred growth, they also come with potential drawbacks, such as high fees, lack of liquidity, inflation risk and complexity. A 1035 exchange may be a useful tool to move funds from one annuity or life insurance policy to another annuity without triggering taxes or penalties.

Before deciding to buy an annuity or use a 1035 transfer, it is important to carefully consider your wealth goals and consult with your wealth advisor or tax advisor to determine the best course of action.

About the author: As a wealth advisor, Maryann Vognild - CFP®, works with clients to simplify their complicated finances so they can focus on what is most important in their lives. This process covers everything from developing plans for stock options and restricted shares to issues around deferred compensation and other employer incentive plans, while also considering current and future tax implications. She loves helping her clients find unique solutions tailored to their individual needs.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. The above is a hypothetical scenario and is not a real-life example of an annuity or annuity conversions. Buckingham Strategic Wealth does not recommend or provide recommendations on annuity or insurance products. Individuals should reach out to a properly licensed individual to discuss the annuity products and the risks associated with them. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. R-23-5640

The content of this article was written by a third party, not an employee of Northwest Wealth Management.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105