From Oct. 15 to Dec. 7, 2022, qualified participants can sign up to take part in the federal government’s insurance plan. If you are overwhelmed by the process, definitions and complexities of Medicare, you are not alone. According to the Centers for Medicare & Medicaid Services (CMS), almost 64 million Americans were fully enrolled in the Medicare program in October 2021. That’s a lot of medication and doctor visits. For those navigating enrollment this year, these are the key questions clients often ask.

Most Americans enroll in Medicare when they turn 65. The Initial Enrollment Period (IEP) runs for seven months total – three months prior to your birth month, your birth month and three months after your birth month. For instance, if you were born in April, you are eligible to enroll January through July of the year you turn 65. During this time, you will have guaranteed acceptance for all Medicare plans, meaning you cannot be denied coverage for any reason for any part of Medicare. Once you sign up, your Medicare coverage will begin either on the first day of your birth month or the first of the month after you enroll after your 65th birthday.

If you are still employed or receive health insurance through your employer’s plan, a spouse’s plan or a union group health plan and your employer has 20 or more employees, then you do not need to enroll in Medicare when you turn 65. You can wait until you officially terminate from your group health plan, either through retirement or loss of employment.

Medicare regulations require that anyone covered by a small employer plan with less than 20 employees must enroll in Medicare at age 65 instead of the group plan.

Which elements of Medicare do I need to sign up for?

There are essentially five main components of Medicare, and each serves a specific purpose. Here is a brief explanation of each component and some of the benefits they provide:

Medicare Part A – Hospital Insurance

Medicare Part B – Physicians and Medical Tests

Medicare Part C – Medicare Advantage

Medicare Part D – Prescription Drug Coverage

Medicare Supplement/Medigap Plan

While everyone who enrolls in Medicare will sign up for Parts A and B, you will need to make a choice on what other plans you will choose. For full enrollment of Medicare, you will choose one of two paths:

Your monthly cost for Medicare will vary depending on the type of Medicare coverage you choose, the specific plans you enroll in and your annual income.

The good news is that for most people, Part A costs you nothing. These premiums are covered by the federal payroll taxes we pay. For Part B, the base monthly premium is $170.10 for 2022, and this applies to everyone on Medicare. Around November, new premium amounts will be announced by Social Security.

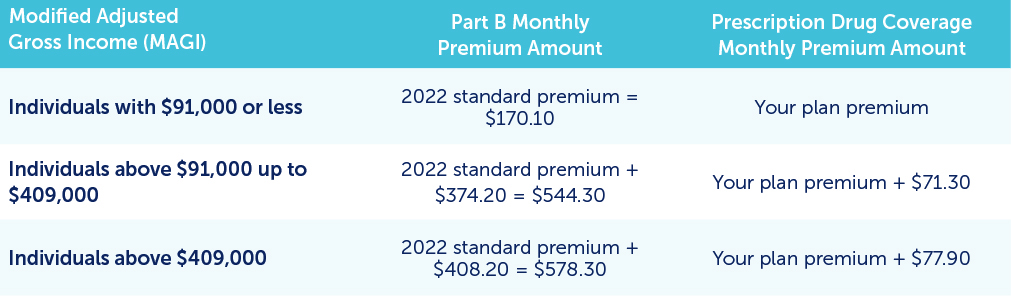

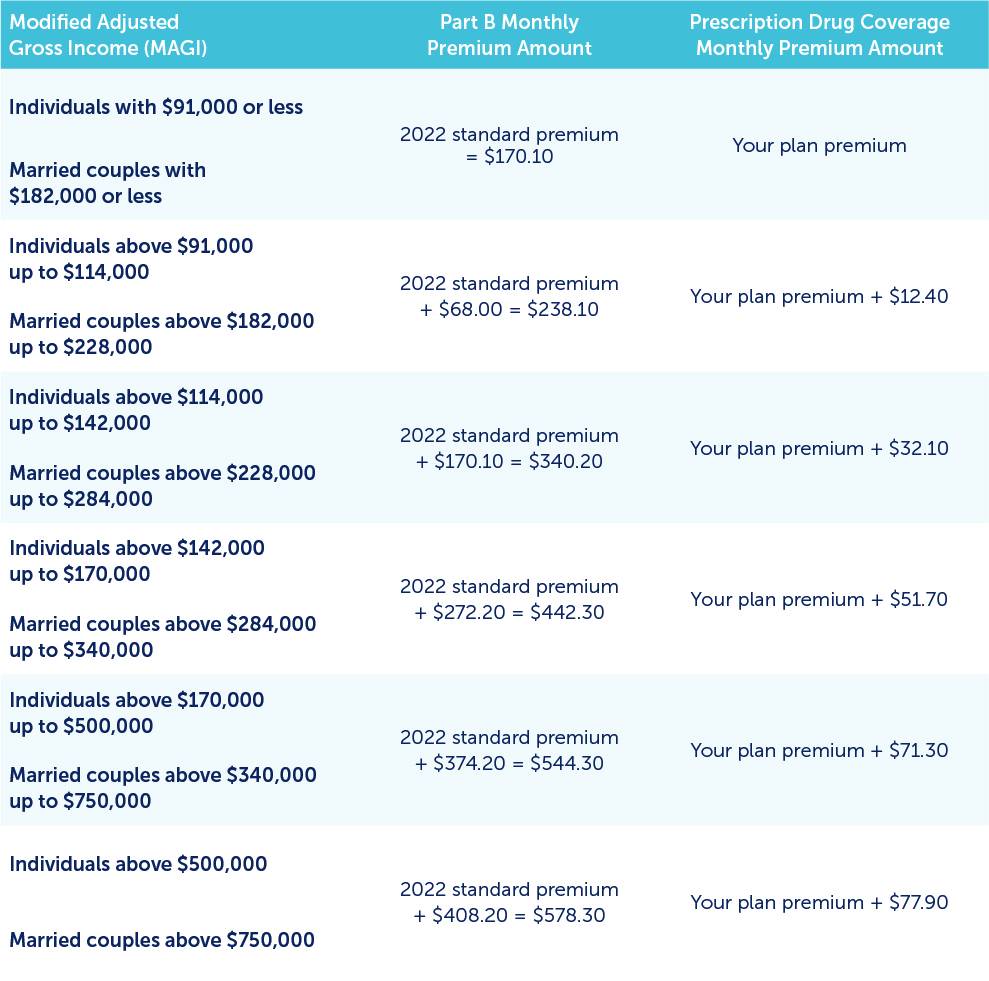

However, depending on your income, your Part B premium may be higher due to an Income Related Monthly Adjustment Amount (IRMAA). This is determined based on your income reported in your tax returns for the two prior years. If you earned over $91,000 those years and are enrolled in?Medicare Part B?and/or?Part D, there will be a surcharge added to these elements. Social Security reviews your Modified Adjusted Gross Income (MAGI) each year, which is based on your income from the prior year, and reassess how much your Part B premiums will be for the upcoming year.

For couples who are married and file separately, the 2021 income tiers and adjustments are:

Once you have met the qualifications to enroll in Medicare, how do you sign up? The quickest and easiest way is online with the Social Security Administration at www.ssa.gov. You’ll need to create a “my Social Security” account prior to enrollment. You can also enroll by calling Social Security at 800-772-1213 or visiting your local Social Security office.

Your retirement shouldn’t be spent sifting through hours of red tape to receive the medical care you need and deserve. If you have questions about the facets of Medicare, please reach out to your advisor. Cheers to a healthy year!

As an Onboarding & Integration Advisor, Scot Colgrove, CFP® enjoys breaking down complex issues to simpler, more easily understood concepts. He and his team lead training on the latest systems, processes and the firm to help new teams acclimate to Buckingham. He serves as an advocate for the joining firms whenever needed. His goal is to make the transition as anxiety free as he can for them.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party information and is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated other otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this information. 22-4422

The content of this article was written by a third party, not an employee of Northwest Wealth Management.

The contents of any report published herein are for informational and educational purposes only. The articles are not to be construed as investment, tax, financial, accounting, or legal advice. Individuals should seek independent advice from a tax professional based on his or her individual circumstances.

The analysis contained in any publication published or otherwise disseminated by Buckingham Strategic Partners (BSP) on this site is based on the data available at the time of publication which may become outdated or otherwise superseded at any time without notice, and the opinions of BSP. Certain information contained therein is based upon third-party sources, which BSP believes to be reliable, but is not guaranteed for accuracy or completeness. Neither the SEC nor any other federal or state agency or non-U.S. commission has confirmed the accuracy or determined the adequacy of information published or disseminated by BSP. Any publication or dissemination of information to the contrary is unlawful. Each reader acknowledges the contents published or otherwise disseminated by BSP is the sole property of BSP and any reproduction or distribution of such information, in whole or in part, other than for its intended purpose with credit provided to BSP, is prohibited. BSP reserves the right to remove, alter, edit, or adapt any third-party content published, contributed, or subject to applicable law.

By clicking on any of the links within the articles on this site you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105