Over the past century, the typical American home has been a picture of independence and self-reliance. An emphasis on the nuclear family in the post-war era led to homes that were designed for privacy and seclusion — as opposed to communal living with extended family — which largely represents the housing landscape today. But recent data shows that multigenerational living is on the rise. As the makeup of American households continues to evolve, the housing market must be prepared to evolve with it.

Multigenerational households have been on the rise for decades. In 2016, a record 64 million people — 20% of the U.S. population — lived in a multigenerational household, compared to an all-time low of 12% in 1980.1 A 2019 survey found that 41% of Americans buying a home were considering accommodating an elderly parent or an adult child.2

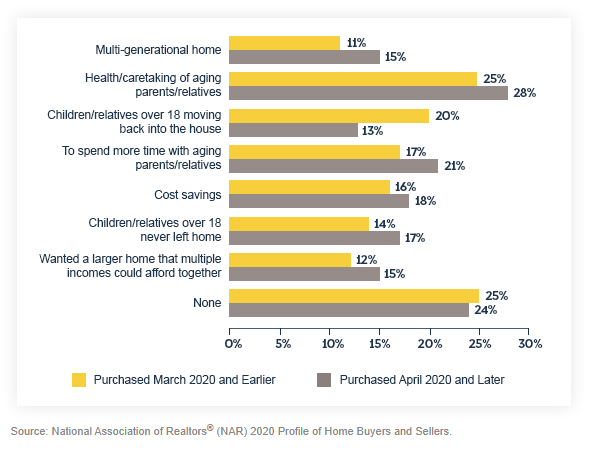

Since the pandemic began, the demand for multigenerational homes has increased. In 2020, only 11% of homes purchased in March or earlier were multigenerational; after COVID-19 was declared a pandemic, that figure jumped to 15%.3 People who purchased a multigenerational home last year did so to take care of aging parents or relatives, to take advantage of cost savings, or to house children over 18 who either moved back home or never left.

A more racially and ethnically diverse population has contributed to the multigenerational trend. According to Pew Research Center, Asian and Hispanic populations are growing at a more rapid pace than the white population, and those groups, along with Blacks and other minorities, are more likely to live with extended family than white households.1

The socioeconomic benefits of living together are also fueling the multigenerational household. Shared living arrangements help ease the economic burden of housing costs, especially for older Americans in their retirement years as well as young adults who are saddled with student loans and other debt. As we face an ongoing housing inventory shortage and rising home prices, a multigenerational home provides both a financial and social safety net for families.

Today’s predominantly single-family housing supply isn’t designed to house multiple generations under one roof. As demand for multigenerational homes continues to grow, so too will the demand for flexible living spaces that allow for both privacy and togetherness. A multigenerational home typically has a separate entrance and its own living space and kitchenette — aka an “in-law” unit.4 These spaces are often designed with accessibility in mind for elderly residents.

For some, creating a functional shared space may involve retrofitting or adding on to their existing homes, while others may choose to purchase or build a larger home with more bedrooms and bathrooms. Some builders are even offering ultigenerational floor plans to accommodate this growing market.

For housing industry professionals, the multigenerational market is rife with untapped potential, and it’s up to us to meet the needs of this emerging homebuyer. While the means for doing so will become more evident as this market grows, here are two ways in which we can better support the multigenerational buyer today:

When you interview clients, ask questions to identify what’s important to them. Do they need a private suite or detached “in-law” house? Who will be living together: adult children and their elderly parents, college grads and their parents, household members spanning three or more generations? Know what they’re looking for so you can present homes that can accommodate their specific needs. Also, if multiple people will be making the buying decision, set clear expectations as to who gets the last say — and how to adjust course if you reach an impasse.

Most of today’s homes aren’t set up to house extended families, which can be discouraging for home shoppers. Until more houses are built to accommodate shared living arrangements, help clients see the potential that exists in the properties that are available. Point out areas that can be repurposed or renovated to suit their needs. Closing off part of a house and adding a separate entrance can transform a traditional single-family property into multiple living spaces.

The American household is at a unique moment in history. While we may never see the nuclear family disappear entirely, the cultural shift toward multigenerational living will likely continue to grow and reshape the way we think of “home” for the foreseeable future. Catering to this niche market provides an opportunity to grow your business while solving a largely unmet need in the industry today.

Sources:

[1] Pew Research Center.

[2] John Burns Real Estate Consulting.

[3] NAR 2020 Profile of Home Buyers and Sellers.

[4] Realtor® Magazine.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105